Top Cost Attribution Tools to Streamline Your Budgeting in 2026

Tracking expenses and understanding how your budget is being allocated can be a challenge, especially as businesses grow and scale. In 2025, cost attribution tools will provide the clarity and efficiency necessary to optimize spending and enhance financial decision-making across departments. Read on.

Let’s be honest, tracking where your money goes isn’t always as clear-cut as it should be. You know budgets are being spent, but do you know exactly how, where, and why? If the answer involves a few spreadsheets and a bit of guesswork, you’re not alone.

As businesses grow and operations become more complex, financial visibility becomes more than just a helpful metric. It becomes a strategic advantage. Leaders want more than just numbers on a dashboard. They want clarity, accountability, and the ability to act on insights in real time.

This is where cost attribution becomes essential. And more importantly, the right tools that support it.

A strong cost attribution tool does more than organize expenses. It helps connect the dots between what you’re spending and the outcomes you’re aiming for. By breaking down costs across departments, projects, clients, or campaigns, these tools turn financial data into decisions you can trust.

In this blog, we’ll look at the top cost attribution tools for 2026. Whether you’re managing a finance team, running multi-department operations, or simply want better control over your budget, these tools are built to help you streamline the process and gain financial clarity.

What Is Cost Attribution and Why Do You Need a Tool for It in 2026?

Cost attribution is simply the process of assigning business expenses to specific departments, projects, or products. It helps businesses track where their money is going and why. By understanding the breakdown of costs, companies can make smarter financial decisions and allocate resources more effectively.

So why is it more important than ever in 2026? With rising costs, the shift to remote work, and increasingly complex business operations, getting a clear picture of your expenses is crucial. Without a solid view of where your money is being spent, it’s harder to stay agile and make informed decisions that drive growth.

This is where cost attribution tools come into play. They automate and streamline the process, providing real-time insights that give businesses better control over their budgets and financial strategies.

What to Look for in a Cost Attribution Tool

- ERP/Accounting Integration:

- Multi-Department Cost Mapping:

- Scalability & Usability:

- Industry Relevance:

Ensures smooth data flow and reduces manual entry.

Tracks expenses across teams for clearer insights.

Grows with your business and is easy to adopt.

Tailored features that meet sector-specific requirements.

Top 5 Tools for Cost Attribution in 2026

Apptio: Purpose-Built for Technology Cost Management

Apptio is a leading solution in the Technology Business Management (TBM) space, helping organizations allocate, analyze, and optimize IT spending. It breaks down costs by application, service, or business unit, giving leaders visibility into where their technology budget is going. Apptio’s automation streamlines manual reporting, enabling finance teams to make faster, data-driven decisions.

Key Features

- Automated Cost Modeling:

- ERP and Cloud Integrations:

- Business-Centric Dashboards:

- Custom Allocation Rules:

- Industry Benchmarking:

Reduces manual work by allocating costs across apps, departments, and services using built-in rules.

Seamlessly pulls data from systems like SAP and ServiceNow, ensuring accurate, real-time financial insights.

Tailors views for IT, finance, and executives so each team sees data relevant to their priorities.

Allows granular attribution based on custom business logic, ideal for large-scale or matrixed organizations.

Helps teams understand how their tech spend compares to industry peers, supporting better budgeting.

Google Cloud: Streamlined Attribution for Cloud-Native Operations

Google Cloud’s native cost management tools let users assign costs through resource labels and project structures. Its powerful billing exports and integration with BigQuery allow teams to build detailed cost dashboards and automate reporting. Ideal for engineering-heavy teams, it brings clarity to fast-moving, complex environments.

Real-World Example: A fast-scaling SaaS company running Kubernetes uses tags like team=product or service=auth. With BigQuery and Looker, finance builds dashboards to view monthly spend by feature or department. This visibility helps them cut underutilized services and reallocate budgets to high-growth areas, supporting both agility and cost control.

SAP Analytics Cloud: Unified Financial Planning and Cost Insight

SAP Analytics Cloud merges financial planning, forecasting, and real-time analytics in one solution. It empowers finance leaders to simulate future costs, understand operational drivers, and align strategic plans with actual spend. For businesses using SAP ERP systems, it provides a frictionless extension of existing data pipelines.

Capabilities and Benefits

- Live Data Connectivity:

- Predictive Cost Modeling:

- Integrated Planning & Reporting:

- Cross-Team Collaboration:

- Scenario Analysis:

Connects directly to SAP S/4HANA, so data is always current without manual syncing.

Uses AI to project future expenses based on historical patterns, improving budgeting accuracy.

Lets users build forecasts and financial statements in one place, streamlining workflows.

Finance and operations teams can co-develop plans using shared tools and real-time data.

Simulate “what-if” situations (e.g., cost increases, headcount growth) to plan for contingencies.

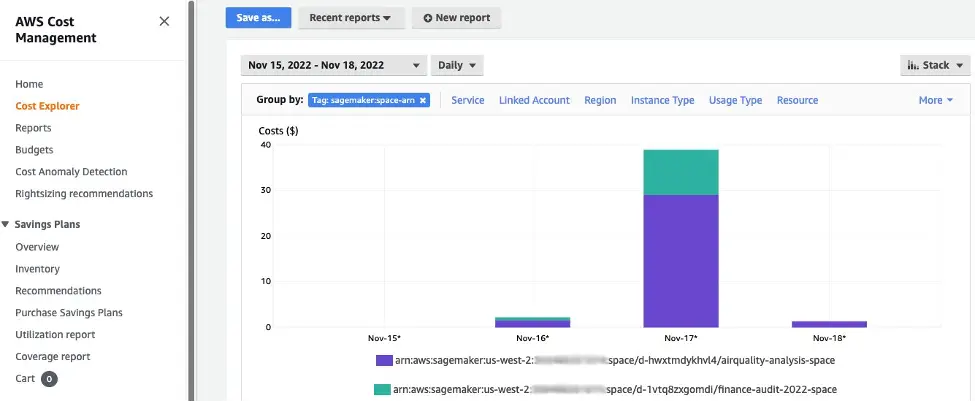

Amazon AWS: Deep Dive Attribution for Cloud-First Enterprises

AWS offers a comprehensive suite of cost tools like Cost Explorer, Budgets, and cost allocation tags. With them, teams can monitor usage, forecast spend, and track costs by service or team. It’s incredibly powerful but requires strong operational discipline to fully leverage.

Pros:

- Granular Usage Insights:

- Automated Budget Tracking:

- Third-Party Tool Compatibility:

Breaks down spend by service, region, and tag, giving engineers and finance real accountability.

Sends alerts when usage nears thresholds, helping avoid budget overruns.

Works with leading FinOps platforms for enhanced analysis and reporting.

Cons:

- Requires Consistent Tagging:

- Steep Learning Curve:

- Manual Maintenance:

Without a unified tagging strategy, cost attribution becomes fragmented and unreliable.

Non-technical finance users may struggle without proper training or IT support.

Dashboards and reports require regular upkeep to stay relevant and accurate.

CloudCheckr: Cost, Compliance, and Control in One Dashboard

CloudCheckr offers more than cost attribution; it’s a full governance platform that brings together financial visibility, security audits, and compliance reporting. Particularly strong in regulated industries, CloudCheckr helps organizations manage multi-cloud spend while staying aligned with policies and standards.

Unique Value Proposition

- Multi-Cloud Support:

- Compliance Monitoring:

- Security Posture Tracking:

- Policy Enforcement:

- Audit-Ready Reports:

Tracks spend across AWS, Azure, and hybrid environments, enabling full-stack visibility in one place.

Alerts users to non-compliance with frameworks like HIPAA and GDPR, reducing legal and audit risks.

Detects misconfigurations and vulnerabilities tied to resource usage, linking financial and security metrics.

Applies rules to prevent over-provisioning, reducing unnecessary costs.

Generates detailed reports that meet the standards of financial and compliance teams, easing regulatory reviews.

Pro Tip- Many cost attribution tools allow you to automate reporting and cost allocation rules. Utilize these features to minimize manual tasks and gain real-time insights. Automation not only saves time but also reduces the risk of human error.

| Tool Name | Purpose | Key Feature |

|---|---|---|

| Apptio | Helps manage and optimize IT costs across departments | Automated cost modeling with real-time data integration |

| Google Cloud | Provides detailed cost insights for cloud operations | Native resource tagging with BigQuery integration |

| SAP Analytics Cloud | Integrates financial planning and cost forecasting | AI-powered cost forecasting and real-time expense modeling |

| Amazon AWS | Tracks and optimizes costs across AWS services | Granular cost reports and forecasting capabilities |

| CloudCheckr | Provides cloud cost management and compliance tracking | Multi-cloud cost tracking with built-in compliance features |

How to Choose the Right Cost Attribution Tool for Your Needs

Selecting the right cost attribution tool is essential for streamlining your budgeting and improving financial visibility. To make the best choice, consider these key factors tailored to your business’s specific needs and operations.

1. Consider Your Business Size and Structure

The size and structure of your business will dictate which features you need from a cost attribution tool.

- Solo Entrepreneurs or small businesses typically need an affordable tool that provides basic cost tracking and integrates well with accounting software. These tools should be simple, intuitive, and cost-effective.

- Mid-sized businesses usually require a more robust system that can handle multiple departments, generate customizable reports, and automate recurring tasks such as cost allocation. You’ll want flexibility and scalability as your business grows.

- Enterprises require comprehensive tools with advanced capabilities, including multi-cloud support, deep ERP integration, role-based access, and advanced analytics. Enterprise-grade solutions should provide seamless collaboration across departments and facilitate complex cost attribution workflows.

2. Map Your Current Budgeting Workflow

Understanding your existing cost attribution process is crucial for identifying a tool that seamlessly integrates into your workflow. Take time to assess:

- How and where are costs currently being tracked?

- Are departments independently managing budgets, or is there a central finance team?

- Are you relying on manual processes, such as spreadsheets, or using existing software for certain aspects of cost tracking?

Knowing where your current system is lacking will help you pinpoint which features you need in a new tool, such as better integration, automation, or enhanced reporting capabilities.

3. Evaluate Integration Needs

A cost attribution tool must seamlessly integrate with your existing tech stack to avoid data silos and manual work. Here’s what to consider:

- Accounting Software:

- ERP Systems:

- CRM and Billing Platforms:

Verify compatibility with platforms such as QuickBooks, Xero, or NetSuite to ensure seamless financial data flow.

If your business utilizes ERP systems such as SAP or Oracle, ensure the tool can integrate with these systems for accurate cost allocation.

For businesses relying on customer relationship management (e.g., Salesforce) or billing tools (e.g., Stripe), integration is crucial for attributing costs across departments.

Integration is crucial to maintaining data accuracy and minimizing manual entry, which in turn drives efficiency.

4. Prioritize Your Must-Have Features

Every business has unique needs, so identify the key features that will make the biggest impact. Some common priorities include:

- Real-time Data Access:

- Multi-Departmental Cost Mapping:

- Customizable Reporting:

- Automation:

If your business needs to make decisions quickly, prioritize tools with real-time data and automated reporting.

If your organization spans multiple departments, look for a tool that can allocate costs to individual teams, products, or services.

Ensure the tool allows for tailored reports that reflect your business’s specific financial metrics and goals.

Automation is crucial in reducing manual data entry and minimizing error-prone tasks. Look for tools that can automate data syncing, reporting, and even cost allocation rules.

Ensure the tool aligns with your most critical needs to enhance financial transparency and minimize administrative burden.

5. Budget and ROI Analysis

While it’s tempting to focus solely on the price of the tool, consider the broader return on investment (ROI) it will generate for your business. A higher upfront cost could save time and resources in the long run by:

- Reducing manual work and administrative overhead.

- Improving the accuracy of cost allocation helps avoid budget overruns.

- Enhancing visibility into spending patterns, enabling smarter financial decision-making.

When evaluating cost, think about the long-term value a tool can bring, not just its immediate price tag. The right cost attribution tool contributes to financial efficiency and improved budgeting practices.

Key Takeaways

- Cost attribution is essential for businesses in 2026, offering clarity on where your money is going and enabling smarter financial decisions.

- Top tools for cost attribution, such as Apptio, Google Cloud, and AWS, help automate cost tracking, integrate with existing systems, and improve financial visibility.

- When selecting a cost attribution tool, consider factors such as your business size, current workflow, integration requirements, and essential features.

- A good tool should provide real-time data, customizable reporting, and scalability to grow with your business.

Don’t focus solely on cost; consider long-term ROI, as the right tool can save time, automate manual tasks, and improve decision-making.

Conclusion

When it comes to managing your business’s finances, the right tools can make a world of difference. Cost attribution provides you with the clarity and insight needed to make smarter decisions, optimize your spending, and ultimately drive growth. With the right tool in place, your business can break free from the uncertainty of manual processes and embrace a future where financial data drives impactful decisions.

Are you ready to unlock the power of accurate financial insights? Talk to Us!

Our experts at DigGrowth can help you find, implement, and optimize the perfect cost attribution tool tailored to your unique needs.

Reach out to us at info@diggrowth.com and start transforming your financial management today.

Ready to get started?

Increase your marketing ROI by 30% with custom dashboards & reports that present a clear picture of marketing effectiveness

Start Free Trial

Experience Premium Marketing Analytics At Budget-Friendly Pricing.

Learn how you can accurately measure return on marketing investment.

Additional Resources

How Predictive AI Will Transform Paid Media Strategy in 2026

Paid media isn’t a channel game anymore, it’s...

Read full post postDon’t Let AI Break Your Brand: What Every CMO Should Know

AI isn’t just another marketing tool. It’s changing...

Read full post postFrom Demos to Deployment: Why MCP Is the Foundation of Agentic AI

A quiet revolution is unfolding in AI. And...

Read full post postFAQ's

Cost attribution tools help small businesses track expenses accurately, improve budgeting, and gain financial insights. They enable better resource allocation and identify areas for cost reduction, helping businesses make smarter financial decisions.

While traditional budgeting focuses on overall expenses, cost attribution assigns costs to specific departments, projects, or products, offering deeper insights into spending patterns and enabling more precise financial planning and decision-making.

Yes, many cost attribution tools support multi-currency operations, allowing businesses with global reach to track expenses across different regions and currencies. This feature ensures accurate financial reporting and better resource management across various markets.

Most cost attribution tools prioritize data security with encryption, multi-factor authentication, and regular security updates. Always check for compliance with regulations like GDPR or HIPAA to ensure your financial data is properly protected.

Implementation timelines vary, but on average, it can take anywhere from a few weeks to a couple of months depending on your business’s complexity, the tool’s features, and integration requirements with existing systems.